When it comes to building wealth, leverage is one of the most powerful tools available to property investors. It allows you to control large assets with relatively small initial investments, unlocking the potential for significant growth. Here’s how leverage works and why it’s such a game-changer in property investment.

Why Leverage Matters

The world’s wealthiest investors focus on the number of assets they control—not how many they’ve paid off. The key lies in the power of leverage: borrowing funds to acquire high-value assets while letting those assets grow and generate income.

Let’s compare leverage in property to other investments:

• Gold: A $40,000 investment in gold growing at an average of 8% annually becomes

$43,200 after one year and $46,656 after two years—a net profit of $6,656.

• Stocks: If you’re skilled enough to achieve a 20% annual return, your $40,000 grows to $48,000 in the first year and $57,600 in the second—a net profit of $17,600.

But neither gold nor stocks can compete with the returns leverage can generate in

property.

The Leverage Advantage in Property

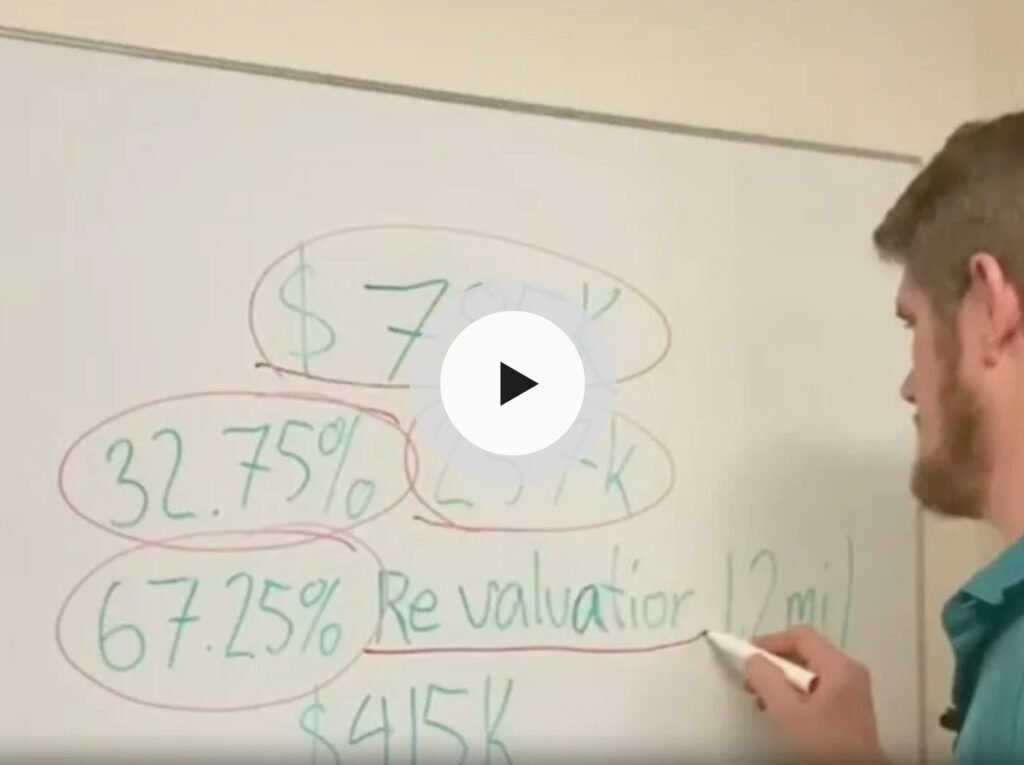

With a $40,000 deposit, you can control a property worth $800,000. Assuming an average growth rate of 7%, the property’s value grows to $856,000 after one year and $916,000 after two years. That’s a net profit of $116,000—far surpassing gold or stocks. What makes this even more powerful is that the growth applies to the total property value, not just your deposit. Additionally:

• Rental Income: Tenants contribute to covering your loan repayments.

• Tax Benefits: Interest payments and other expenses are often tax-deductible in Australia.

• Equity Creation: The equity you build can be used as a deposit for your next property,

enabling portfolio growth.

Leverage in Action: Building Wealth

Here’s how leverage transforms a single property into financial freedom:

1. Year 1: Purchase a property worth $800,000 with a $40,000 deposit.

2. Year 2: Revalue the property at $856,000 and refinance to access $56,000 in equity.

3. Year 3–5: Use the equity to purchase additional properties, repeating the process. Within 10 years, your original $800,000 property could be worth over $1.6 million, with rental income potentially doubling during this period. By owning just three investment properties, you can replace a typical income and retire. Everything after that is wealth creation for lifestyle improvements.

Risks and How to Manage Them

Leverage comes with risks, but these can be managed with proper planning:

• Market Fluctuations: Property values can dip in the short term, so focus on long-termgrowth.

• Interest Rate Increases: Maintain a financial buffer to handle higher repayments.

• Vacancies: Choose properties in high-demand locations to minimise the risk of lost rental income.

Working with property professionals ensures you structure your loans and investments to maximise rewards while mitigating risks.

Leverage and NDIS Properties

For investors seeking even greater returns, NDIS properties offer unique opportunities to utilise leverage:

• High Yields: Rental returns significantly higher than standard properties can help offset loan costs.

• Equity Uplift: Building an NDIS property or securing tenants in a completed property can create instant equity, which can be leveraged for further investments.

Start Leveraging Today

Leverage isn’t just about borrowing—it’s about creating opportunities. With the right strategy, you can build a property portfolio that generates consistent income and long-term growth. At Topstone Property Invest, we specialise in helping clients harness the power of leverage to achieve their financial goals. Whether you’re starting your journey or looking to expand your portfolio, we’ll guide you every step of the way.