A Custom Hybrid SDA/SIL Property Development in WA

Annual gross income potential

SDA side: From $72,095 to $83,270 SIL sid: $55,000 Total: 127,095 to $138,270. Gross Yield: 15%-17%

Background

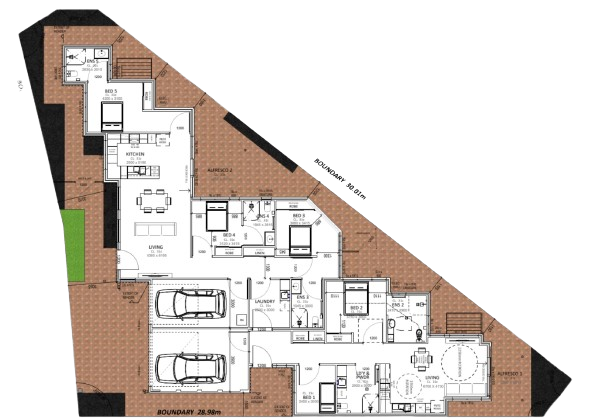

This client initially approached us with an interest in purchasing a completed house-and-land NDIS property on a single contract. He was seeking high-yield investment opportunities but faced limitations with available options. After learning more about his situation, we explored alternative paths that could better suit his unique needs. During our conversation, the client mentioned owning a block of land in WA. Seeing an opportunity, we suggested building a customised NDIS property on this land, highlighting that a purpose-built solution could optimise yield. This block presented its own challenges, as it was irregularly shaped, making a traditional NDIS build impractical. To maximise potential, a custom dual-key design was essential.

Challenges

1. Irregular Land Shape:

The triangular block required a unique architectural approach, as standard NDIS layouts wouldn’t fit.

2. Location-Based Demand and Financing:

The property is located in a postcode flagged as challenging for SDA lending. This meant that a high-support SDA-only design wouldn’t attract financing easily, as the bank would need strong evidence of consistent demand and alternative income potential.

3. Market Dynamics:

Although demand for NDIS housing was present, there was notable future supply in the area, making it crucial to develop a property that stood out in terms of desirability and adaptability.

Solution

Our strategy was to create a dual-key design to offer flexible income sources that would appeal to both the bank and potential participants:

• Design Approach

On one side, the design accommodates three Supported Independent Living (SIL) funded participants. The income from this side is stable at $55,000 per year, regardless of whether one, two, or three participants are housed. This setup was attractive to lenders due to its reliable income stream and made it easier to secure financing.

• SDA Component

The other side of the property was designed for one SDA participant with a carer, offering a private, high-quality living environment without the need to share with multiple residents. This makes it more attractive to potential tenants, improving occupancy prospects. SDA income from this side ranges from $72,000 to $83,000 annually.

• Alternate Scenarios for Due Diligence

To secure approval, we prepared three scenarios: 1. The intended dual-key design with both SDA and SIL tenants. 2. Full SIL occupancy on both sides, maximising rental income if SDA demand temporarily dips. 3. A co-living arrangement, which, while lower in income than SDA, offers flexibility and a strong fallback option for rental income.

Result and Impact

The bank approved financing based on the strength of these scenarios, ensuring the client has a flexible, income-optimised property ready to move forward. This project, in progress, exemplifies the value of customised planning and strategic design in overcoming market and lending barriers.

Insight and Expertise

This success highlights how expertise in NDIS property goes beyond traditional real estate transactions. Our comprehensive knowledge of the niche market, combined with a network of builders, designers, and providers, enabled us to guide the client through the complexities of financing, design, and market appeal. Rather than settling for standard product, we provided a tailored solution with long-term potential.