Investing in property is often seen as one of the most reliable paths to financial

independence. But success in this journey depends on adopting the right strategy—and sticking to it. Among the many approaches, the ‘Buy, Hold, Revalue, Keep Going’ strategy stands out as a proven method for building long-term wealth. Here’s why.

Why ‘Buy, Hold, Revalue, Keep Going’ Works

1. Steady Growth Over Time

Property markets, while not immune to fluctuations, have consistently demonstrated growth over the long term. Holding onto properties allows investors to ride out market dips while benefiting from the overall upward trend.

Example: In Australia, property values have historically doubled every 10 years on

average. Imagine what holding a well-chosen property could mean for your wealth in 20 years.

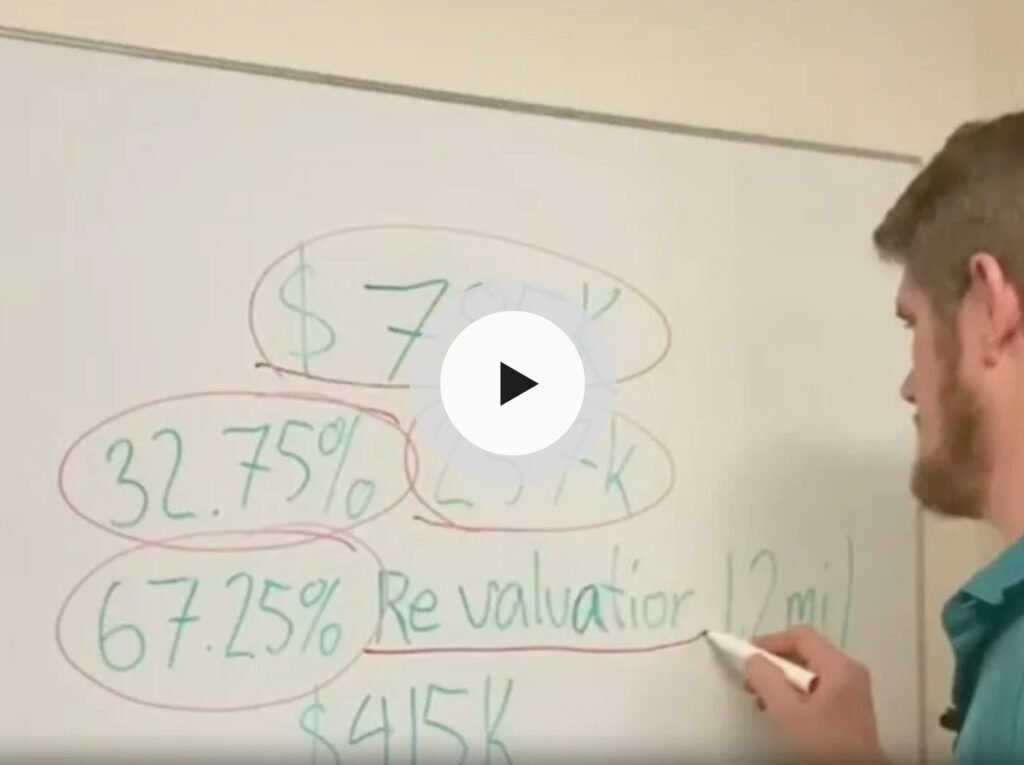

2. Leverage Your Assets for More Opportunities

By revaluing your property, you can unlock equity—without selling it. This equity acts as leverage to invest in additional properties, allowing your portfolio to grow exponentially. Key Tip: Work with a lender who understands property investment strategies to maximise

your borrowing power.

3. Flexibility in Investment Types

Whether you choose to build a property from scratch or buy one that’s already completed, the ‘Buy, Hold, Revalue’ approach accommodates both.

• Building from Scratch: With a house and land package, you can potentially add equity at two stages—on completion of construction and again once the property is tenanted.

• Buying Completed Properties: This can also be divided further. You can purchase a completed property without tenants, find tenants, and achieve instant equity after tenancy. Alternatively, you can invest in a property that’s already tenanted, which typically comes at a higher price but offers immediate, steady income.

Overcoming Common Challenges

Many aspiring investors hesitate to take action due to fear, overthinking, or bad advice.Here’s how to move past these hurdles:

• Fear of Failure: Every investment carries risk, but not taking action might be riskier. Ask yourself, “Can I afford to wait 10 years and pay double for the same property?”

• Analysis Paralysis: Instead of endlessly researching, focus on foundational steps like understanding your financial capacity and selecting a growth-focused strategy.

• Family and Friend Opinions: Trust professional advice and data over well-meaning but uninformed opinions.

Why This Strategy Outperforms Others

While some investors focus on flipping properties or timing the market, these approaches me with higher risks and less predictable returns. The ‘Buy, Hold, Revalue, Keep Going’ strategy minimises speculative risk and maximises the benefits of time and compounding growth.

• Less Stress: You don’t need to worry about market timing.

• More Consistency: Focus on building a sustainable, high-performing portfolio.

• Proven Results: Historical data supports this method as a reliable path to financial freedom.

Real-Life Example: A Portfolio in Progress

Consider an investor who started with a single property. Over time, they used equity from the first property to purchase a second and third. By holding and revaluing these assets, they avoided the costs of selling and reinvesting, steadily growing their portfolio while enjoying tax benefits and increasing cash flow. With NDIS properties, for example, investors can unlock equity at different stages based on their approach. Building from scratch allows for uplift upon completion of construction and again after securing tenants, while buying completed properties offers opportunities for equity uplift once tenanted—or predictable income if tenants are already in place.

Ready to Build Your Portfolio?

At Topstone Property Invest, we specialise in guiding investors through every step of the ‘Buy, Hold, Revalue, Keep Going’ strategy. From sourcing high-quality properties to helping you navigate financing and valuations, we’re here to ensure your investments perform as intended.